This paper aims to examine the relationship between board gender diversity and private firm performance. This paper aims to examine how auditors respond through audit fees and audit quality following disciplinary actions imposed by audit regulators in an emerging market setting. Celebrating excellence in accountancy practice, the Top 50+50 Accountancy Firms 2022 spotlights top accounting firms in the UK Read More… An accounting information system is a part of an organization’s information system used for processing accounting data.Many corporations use artificial intelligence-based information systems.

By implementing a single, global platform for managing indirect tax, Adobe achieved compliance, reduced tax management costs, and saved significant ti… The upcoming MTD for income tax self-assessment deadline opens the door for accountants to play a key advisory role once more Read More… Historians of accountancy are right to draw attention to the role of financial regulation among the measures for establishing imperial control. Changes in the governance of medicine therefore parallel similar changes affecting other institutions such as education, accountancy and law. The board claimed he did not have sufficient management expertise despite his accountancy qualification and experience. An accounting error is an unintentional misstatement or omission in the accounting records, for example misinterpretation of facts, mistakes in processing data, or oversights leading to incorrect estimates.

This site is brought to you by the Association of International Certified Professional Accountants, the global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants. The Financial Reporting Council has unveiled plans to stimulate competition and resilience in the UK audit market, with a view to remedying the … BKL became the first major accountancy firm to acquire B Corp status, increasing its attractiveness to new talent Read More… Accountancy was one of the new professions of the nineteenth century but, as with solicitors, professional exclusivity operated by traditional means.

Careers in Accounting

Accounting has existed in various forms and levels of sophistication throughout human history. The double-entry accounting system in use today was developed in medieval Europe, particularly in Venice, and is usually attributed to the Italian mathematician and Franciscan friar Luca Pacioli. Today, accounting is facilitated by accounting organizations such as standard-setters, accounting firms and professional bodies.

- In short, accountancy involves each of the preceding tasks – recordation, classification, and reporting.

- The purpose of this study is to examine which factors explain the use of an in-house internal audit function in a voluntary setting.

- Nassif is a financial professional with more than 20 years of experience as a CPA and financial consultant to individuals and small-to-medium-sized businesses.

- A doctorate is required in order to pursue a career in accounting academia, for example, to work as a university professor in accounting.

- The Panel is a key feature of IFAC’s approach to advancing accountancy education at the global level and instrumental in advising IFAC on how to assist professional accountancy organizations in preparing future-ready accountants.

- The PhD is the most common degree for those wishing to pursue a career in academia, while DBA programs generally focus on equipping business executives for business or public careers requiring research skills and qualifications.

Accountancy is the practice of recording, classifying, and reporting on business transactions for a business. It provides feedback to management regarding the financial results and status of an organization. In addition to being the largest bankruptcy reorganization in American history, the Enron scandal undoubtedly is the biggest audit failure causing the dissolution of Arthur Andersen, which at the time was one of the five largest accounting firms in the world. After a series of revelations involving irregular accounting procedures conducted throughout the 1990s, Enron filed for Chapter 11 bankruptcy protection in December 2001. Due to different publication rates between accounting and other business disciplines, a recent study based on academic author rankings concludes that the competitive value of a single publication in a top-ranked journal is highest in accounting and lowest in marketing.

Board Staff

Financial statements are usually audited by accounting firms, and are prepared in accordance with generally accepted accounting principles . GAAP is set by various standard-setting organizations such as the Financial Accounting Standards Board in the United States and the Financial Reporting Council in the United Kingdom. As of 2012, “all major economies” have plans to converge towards or adopt the International Financial Reporting Standards . Accounting, also known as accountancy, is the measurement, processing, and communication of financial and non-financial information about economic entities such as businesses and corporations. Accounting, which has been called the “language of business”, measures the results of an organization’s economic activities and conveys this information to a variety of stakeholders, including investors, creditors, management, and regulators. 6 of Board rules to more accurately describe the peer review process that certain firms are required to successfully participate in as a condition to the granting or renewal of licenses pursuant to 32 MRS §12252.

Swansea accountancy firm enjoys rapid growth during transition to … – Wales 247

Swansea accountancy firm enjoys rapid growth during transition to ….

Posted: Wed, 19 Apr 2023 05:50:43 GMT [source]

Although our building in Gardiner, Maine is not open to the public due to the COVID-19 health emergency, our staff remains available to resolve your complaints, answer your questions, and continue to deliver high-quality services to consumers and regulated industries. To review the CPA Exam requirements, application process and successful candidates listclick here. Argin has more than a decade of experience in the accounting profession and has been a CPA and Certified Fraud Examiner since 2011. With more than 30 years of experience, Kirby has provided services to individuals and businesses of every size in various industries. Please note that all documents from applications including License, CPA Exam, Transfer of Grades, and Reciprocal applications will be retained by the Board of Public Accountancy for a period of five years. After this period, documents will need to be resubmitted to the Board for processing.

Arkansas State Board

The Board also approves candidates for the Uniform CPA Examination and investigates potential violations of Arkansas Accountancy statutes and rules. Thank you for your patience and cooperation with what has been a difficult renewal season for the Board and licensees. A good investment can become a great one with the right tax treatment, and a great one can sour with poor accounting. When it comes to making informed decisions about important personal and professional choices such as estate and succession planning, there’s no one better suited than your team at The Accountancy. We see business owners, entrepreneurs, and executives working hard to secure their financial futures.

Advisory firms must offer a “more supportive” and holistic approach to clients amid the economic downturn Read More… The 35 Under 35 ranking spotlights young professionals within the accountancy industry who have made significant contributions to their fields, career… While the tax year has just come to a close, accountants should not shy away from preparing for the next year end, this includes seeking wellbeing sup… The new accounting standard provides greater transparency but requires wide-ranging data gathering. This essay urges that the uses of quantification in science, social science, and bureaucratic social and economic policy are analogous in important ways to accountancy. The accountancy profession did not seek graduates to improve social standing.

Michigan State Board of Accountancy

Principle of Consistency — The organization’s accounting processes and standards are uniform. Although accounting and accountancy are often used interchangeably, each term has its own unique definition and practical uses. Ensure that competent, professional and regulated commercial services are available to Alaska consumers. You may download a complete roster of board licensees or just selected types. Keep in mind that not every computer is compatible to retrieving the information on-line.

An educational lesson on UBIT – Journal of Accountancy

An educational lesson on UBIT.

Posted: Thu, 30 Mar 2023 07:00:00 GMT [source]

Standards for international audit and assurance, ethics, education, and public sector accounting are all set by independent standard settings boards supported by IFAC. DePaul is located in the heart of Chicago’s financial and business community, giving you access to work with leading accounting and consulting firms. Job placement is strong among our graduates, who join a large alumni network that reaches to the top ranks of public accounting firms, corporations, non-profits, educational institutions and government agencies. The mission of the Maryland Board of Public Accountancy is to establish educational and professional standards of competence and conduct of certified public accountants in providing financial services for Maryland businesses and citizens.

Requirement to Report Convictions and Changes of Contact Information Within 10 Days of the Occurrence

The year 2001 witnessed a series of financial information frauds involving Enron, auditing firm Arthur Andersen, the telecommunications company WorldCom, Qwest and Sunbeam, among other well-known corporations. These problems highlighted the need to review the effectiveness of accounting standards, auditing regulations and corporate governance principles. In some cases, management manipulated the figures shown in financial reports to indicate a better economic performance. In others, tax and regulatory incentives encouraged over-leveraging of companies and decisions to bear extraordinary and unjustified risk. Generally accepted accounting principles are accounting standards issued by national regulatory bodies. In addition, the International Accounting Standards Board issues the International Financial Reporting Standards implemented by 147 countries.

Auditing is the verification of assertions made by others regarding a payoff, and in the context of accounting it is the “unbiased examination and evaluation of the financial statements of an organization”. Financial accounting produces past-oriented reports—for example financial statements are often published six to ten months after the end of the accounting period—on an annual or quarterly basis, generally about the organization as a whole. Accounting is thousands of years old and can be traced to ancient civilizations. By the time of Emperor Augustus, the Roman government had access to detailed financial information. Employment of accountants and auditors is expected to grow 7% from 2020 to 2030, adding nearly 100,000 new jobs during that period, according to data from the U.S. Individuals entering the profession can pursue a variety of roles, including financial or managerial accountants, internal or external auditors, or government accountants.

License Look Up Find a licensee or a public accounting firm to check their license status. This study aims to investigate why companies use the internal price of carbon for carbon management. This paper aims to examine the association between environmental disclosure and waste performance.

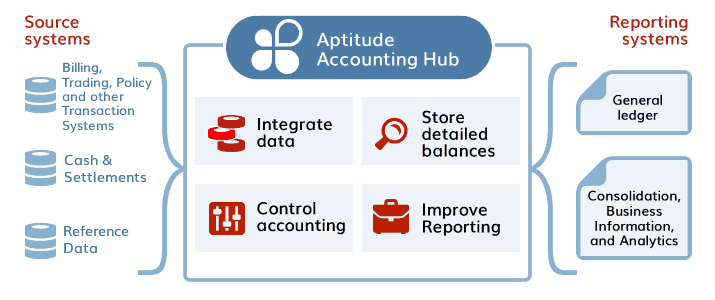

Accounting and auditing services constitute the core activities of accountancy firms, but a wide range of additional services may also be offered, most notably merger audits, insolvency services, tax advice, investment services and management consulting. Increasing use of information technology and digital working practices have facilitated the cross-border supply of accountancy services. Many accounting practices have been simplified with the help of accounting computer-based software. An enterprise resource planning system is commonly used for a large organisation and it provides a comprehensive, centralized, integrated source of information that companies can use to manage all major business processes, from purchasing to manufacturing to human resources. These systems can be cloud based and available on demand via application or browser, or available as software installed on specific computers or local servers, often referred to as on-premise.

However, as of 2012 “all major economies” have plans to converge towards or adopt the IFRS. Principle of Continuity — The short-term and long-term voided check data classifications are based on the notion that the organization’s business will continue. Accountancy includes the measuring, processing and communicating of financial information; managing of detailed financial records; preparation of tax documents; and tracking of an entity’s economic resources. The mission of the Board of Public Accountancy is to protect the public interest by ensuring that only qualified persons are licensed and appropriate standards of competency and practice are established and enforced. Any material change in the conditions or qualifications set forth in the original application for licensure submitted to the office, board or commission. 1,Definitions, to more accurately reflect the terminology used throughout the rules; specifically, to add terms used to describe the administration of firm peer reviews in Ch.

Build your confidence with hundreds of exam questions with hints, tips and instant feedback. In short, accountancy involves each of the preceding tasks – recordation, classification, and reporting. The reporting aspects of accountancy are considerable, and so have been divided into smaller areas of specialization, which are noted below. The results of the efforts of the preceding accountants are accumulated into a set of accounting records, of which the summary document is the general ledger. The general ledger consists of a number of accounts, each of which stores information about a particular type of transaction, such as product sales, depreciation expense, accounts receivable, debt, and so on. Certain high-volume transactions, such as customer billings, may be stored in a subledger, with only its totals rolling into the general ledger.

Accountancy services are classified under the WTO Services Sectoral Classification List (W/120) as accounting, auditing and bookkeeping services . They include financial auditing services, accounting review services, compilation of financial statements services, and bookkeeping services. The Alaska Board of Public Accountancy is staffed by the Division of Corporations, Business, and Professional Licensing. The board consists of five certified public accountants and two public members. Board members are appointed by the Governor and confirmed by the Legislature.

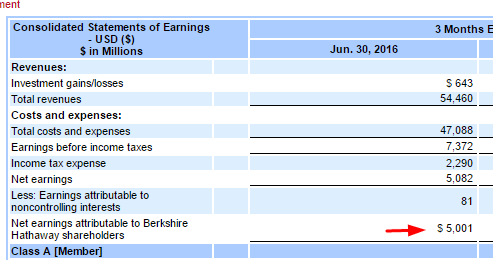

These documents are presented based on sets of rules known as accounting frameworks, of which the best known are Generally Accepted Accounting Principles and International Financial Reporting Standards . Depending on its size, a company may be legally required to have their financial statements audited by a qualified auditor, and audits are usually carried out by accounting firms. Those seeking to expand their employment opportunities in the accounting field may consider obtaining certification as a certified public accountant . This credential can help candidates stand out in a competitive job market, as publicly traded companies are required to have their records audited by a CPA. Financial accounting involves the preparation of financial statements — such as balance sheets, income statements and cash flow statements — for internal and external stakeholders. Managerial accounting involves similar functions, but the information is intended primarily to help internal stakeholders make informed business decisions.

It involves computer hardware and software systems using statistics and modeling. Accountants may work as part of an accounting firm or exclusively for a large company. Because of the essential nature of their role, they can work in any number of industries and sectors, including government agencies and nonprofit organizations. “Accountancy” also is often used as an umbrella term to encapsulate several areas of real-world financial statement management, including preparation, compilation and review.